We understand that life circumstances might lead to difficulty making your mortgage payments. As your mortgage partner, we are here to help if you are facing financial hardship. Whether you need help bringing your account current or are behind on payments and looking to sell, we want to help you navigate options available to you. Please reach out to our Homeowner Assistance Team at 866-312-0292 or email us.

Need Mortgage Assistance?

Whether you’re experiencing hardship due to loss of employment, income reduction, illness or other related impacts, here are your options that may be available to you based on investor guidelines.

Best for those who haven’t yet fallen behind on payments:

Refinance:

- Getting a brand-new loan. Refinancing your mortgage can lower your payment with a different loan term or interest rate.

To refinance, your account needs to be current for the past 6 months.

There can’t be more than one late payment on your account over the past 12 months.

Best for short-term financial hardships:

Mortgage Forbearance:

- An agreement that temporarily reduces or pauses your monthly payment, protecting against foreclosure proceedings and late charges.

If your hardship isn't protected by the CARES act, we'll continue to report the delinquency status of your mortgage and your participation in a forbearance plan to credit agencies.

While the forbearance agreement provides a temporary pause in your mortgage payments, you may submit payments during your forbearance period. If your loan is not current, know that you’re not required to wait until the end of the forbearance term to make payments.

You’re allowed to reinstate your loan at any point. This means you can pay the past due amount and bring your loan current before the forbearance term is over. You may have the ability to work with us to create a repayment option.

These options may be available to you depending on your hardship. There are options to help you stay in your home and bring your mortgage current, and options that allow you to leave your home while avoiding foreclosure. We can answer any questions you may have about these options, including the general eligibility requirements.

Once your forbearance term expires, if you can’t reinstate the loan, other alternatives may be available to help relieving the past due amounts.

Reinstatement:

The quickest way to get your loan back on track. If you have missed payments, you can restore your mortgage by paying the total amount past due at once along with any late fees and other penalties. If you would like to reinstate your loan, please contact our homeowners' assistance team.

Repayment Plan:

An agreement that spreads the past due amount over a specific period, typically 3–6 months, in addition to your normal mortgage payment until the account is brought current.

You will resume making your contractual mortgage payment plus an additional amount each month.

Best for those experiencing short-term to long-term resolved financial hardships:

Deferment:

- A workout that creates a non-interest-bearing balance comprised of missed payments and other past due amounts. Your loan will be brought current and you will continue to make contractual payments as required by the terms provided in your loan’s security instrument.

The deferred balance must be paid when the loan is paid-off, refinanced, or matures (whichever occurs first).

Partial Claim:

A workout that creates a non-interest-bearing subordinate lien comprised of missed payments and other past due amounts. Your loan will be brought current and you will continue to make contractual payments as required by the terms provided in your loan’s security instrument.

The subordinate lien created through the partial claim agreement must be paid when the loan is paid-off, refinanced, or matures (whichever occurs first).

Best for those experiencing long-term to permanent unresolved financial hardships:

Loan Modification:

- A workout that permanently changes the terms of your mortgage loan to generate an affordable mortgage payment and/or resolve a large past due balance.

Changes to your loan may include reducing your interest rate, reducing the interest-bearing principal balance, or extending the loan repayment term.

The investor (e.g., Fannie Mae, Freddie Mac, Ginnie Mae, etc.) may require us to request from a mortgage hardship letter explaining why you’re unable to make your mortgage payments, and additional income documentation to evaluate your eligibility for available loan modification programs.

Allows you to resume making a regular modified monthly payment.

I was impacted by a natural disaster. What are my options?

We understand this may result in late or missed mortgage payments. We are here to help, so please reach out to our Homeowner Assistance Team. We will guide you on mortgage assistance options available, how to apply, and what to expect.

If your property was damaged due to a disaster, click here or information regarding disaster claims.

How can I apply for mortgage assistance?

You can log into our website or app to complete the application online or, if you prefer to submit your application by mail or email, please click the button above to download a PDF. The PDF will include instructions for completing and submitting the package. If you need help, please reach out to our Homeowner Assistance Team at 866-312-0292 or email us. We are eager to support you!

How can I apply online?

Here is a step-by-step overview of the process and what to expect:

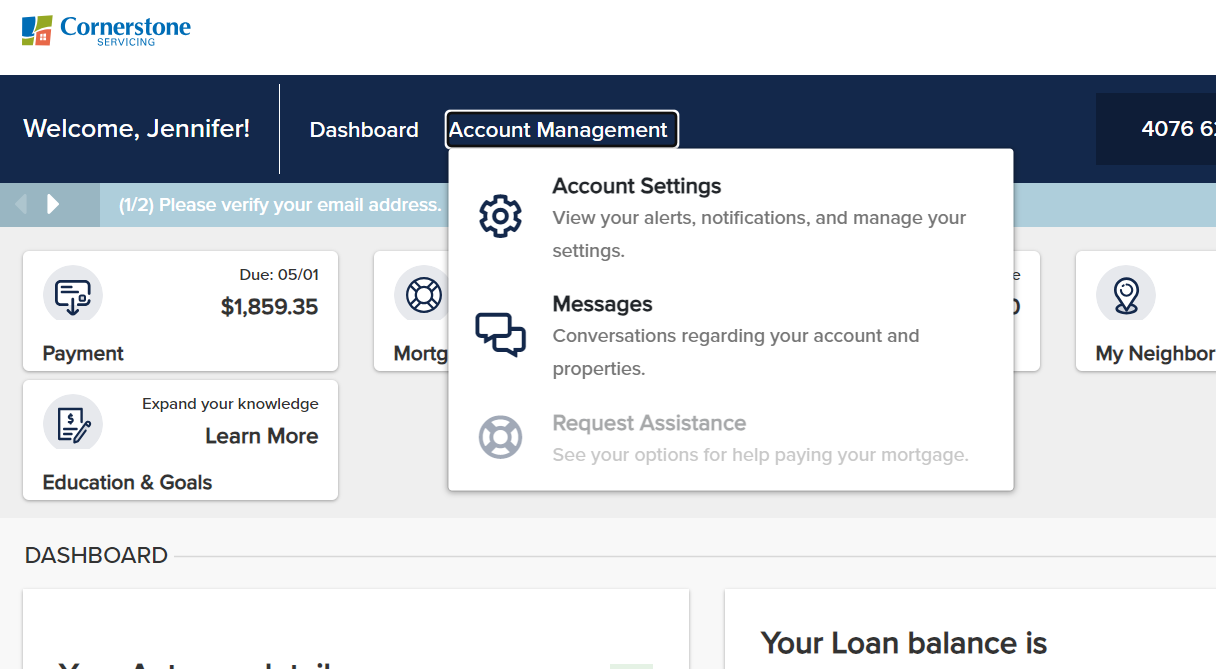

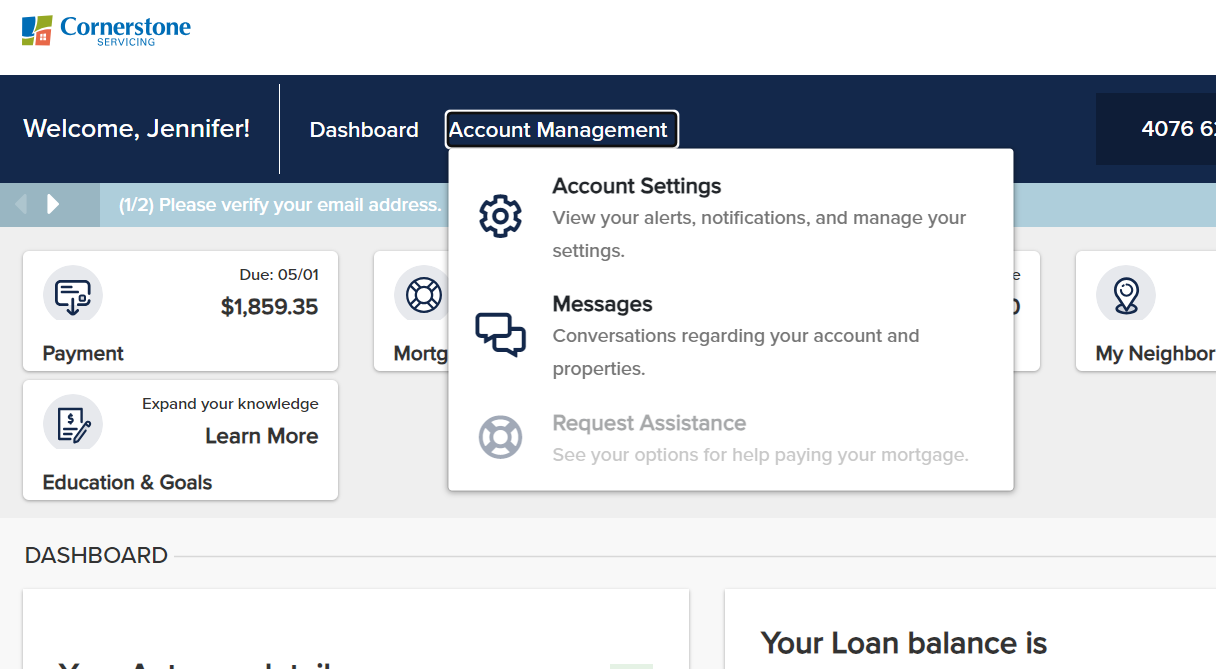

Step 1: Initiate your request for mortgage assistance.

- Login to your account via our website or app.

- Go to the home page and click Account Management.

- Click Request Assistance to continue.

- The sidebar on the left shows the steps you will need to complete. You can use the sidebar to navigate between steps.

- Once you have completed each step, you submit the request.

- Once you have submitted your request, follow the prompts to review and submit your Mortgage Assistance request.

- The system will reflect the request that was submitted. In addition, as long as you have not opted out of email notifications from our website and app, an email confirmation will be sent to your preferred email address.

Step 2: Upload all required documents

- The Your Documents section will display the documents you need to provide as part of your application. Note: If you need a copy of IRS Form 4506 - IVES Request for Transcript of Tax Return, you may download a copy here: Form 4506.

To upload a document, click the dots to the right of the document name and the option to upload will appear.

Click Upload, find the document in the device you are using, and upload the document.

Look for the system to indicate the document uploaded successfully.

Once all required document is uploaded, the Your Documents section will reflect pending review.

Step 3: Decision

- Once your request is completed and all required documents are uploaded, Your Status Tracker will reflect Package Complete and Decision Pending.

Step 4: Trial Payment Plan

- If a trial payment plan is required, you will receive a letter detailing terms.

- As your trial payments are completed, this section will update to show payment status and upcoming payments due.

- Once the Trial Payment Plan is complete, Your Status Tracker will show Plan Monitoring is complete.

- Your Request for Mortgage Assistance status will move to Final Decision Pending.

Step 5: Final Decision

Once Your Status Tracker moves to Final Decision Pending, you can expect to be notified of the decision and, if applicable, receive a final agreement for your signature at least 15 days prior to the effective date of your loan modification.

Step 6: Download/ eSign

You have the option to download and review the documents if needed.

Once you select eSign, you will view the screen with the electronic delivery consent.

Click the checkbox showing “I have read and understood…” disclosure and, if you agree, choose I agree.

Note: In some cases, you may be prompted to contact our Homeowner Assistance Team for information or assistance. Please reach out to us via the information above – we are eager to serve you!

COVID-19 Resources

If you have a hardship related to COVID-19, visit the CFPB’s mortgage and housing assistance portal.

Homeowner Assistance Fund (HAF) in the U.S Department of the Treasury and National Council of State Housing Agencies to provide financial assistance to eligible homeowners who have suffered financial hardships during the COVID-19 National Emergency.

U.S. Military Service Members

If you or any occupant of your home are or recently were on active military duty or related active service, you may be eligible for benefits and protections under the federal Servicemembers Civil Act (SCRA).

As a servicemember you may also find assistance by speaking with someone at your local legal assistance office.

Counseling Resources

The Federal government provides housing counselors, which you can access via the Consumer Financial Protection Bureau or Department of Housing and Urban Development (HUD) or by calling (800) 569–4287.

The Federal-State Unemployment Insurance Program offers benefits to unemployed people who meet state eligibility requirements. Visit CareerOneStop.org to learn about your state’s requirements.

Counseling is also available at no charge from HUD-approved counselors through the HOPE Hotline: (888) 995-HOPE. This housing counseling on-demand service is available 24 hours a day/7-days a week.

If you foresee there isn’t a financially feasible way to keep your home, here are more options for you to avoid the foreclosure process.

Traditional Sale:

Work with a real estate agent to sell your home for an amount that generates proceeds sufficient to pay off your mortgage in full.

Best option for those with equity in their home.

Short Sale:

Selling your home for an amount that generates proceeds insufficient to pay off your mortgage in full.

An agreement where the investor may accept sale proceeds less than the total amount owed on the loan. Once a short sale is completed, the loan will be released.

Short sales can help you leave your home and may have a smaller credit impact than a foreclosure.

Cancellation of debt may have tax consequences. Please consult a tax advisor to discuss potential tax consequences.

In some circumstances, you may be responsible for the difference between the sale proceeds and the total amounts owed on your loan.

Preferred option for those who have little or no equity in their home.

Deed In Lieu (DIL):

An agreement with your investor where you will agree to transfer ownership of your home to your investor, the remaining balance is discharged, and the lien is released.

If you’re unable to qualify or complete one of the options above, you can be considered for this option without having a foreclosure on your record.

You may be able to obtain funds to help relocate to another living arrangement.

While this protects you from formal foreclosure, it will impact your credit.